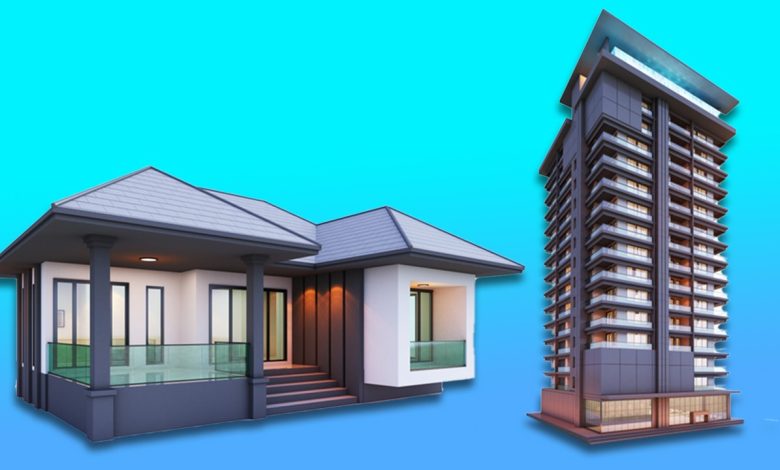

Residential property is essentially a building or home used for living, whereas commercial property is a property used for income generation. It is normally bought as an investment to help build your retirement fund.

Commercial properties are properties that are used for business or trade. They include office buildings, retail stores, warehouses, restaurants, daycare facilities, and storage units. In this article, we talk about the difference between residential and commercial.

They can be hotels, restaurants, offices, shops, and any other construction used for commercial purposes. With the rising cost of living and increasing demand for residential and commercial properties in the world.

Real estate properties have always been people’s first choice for investment. It is very important for one to get the basics right when going for a property of any kind. For example, the choice between real estate property and actually buying a house from the developer.

It is very important to avoid the mistakes made by the others, especially in choosing the location of the property, the building to be bought, the time to buy, and many others. You can read more about residential and commercial property on Evermark Property.

Residential property is a house, building, or land which is designe for the use of one individual or family unit. Commercial property is a building or land which is designe by the owner to be used for business purposes. For example, a tenement building or a warehouse.

Residential means property meant for private use by an individual or family. Commercial property is for business use. For example, a private house is residential; a retail store is commercial.

Residential property is for living purposes and commercial property is for business purposes. It is for live purposes and commercial property is for commercial purposes. Residential property is like a house and commercial property is like a restaurant, shop, school, etc.

When you buy residential property you have to buy residential property like a bungalow, flat and so on and when you buy commercial property you have to buy commercial property like shop, school, and so on. Residential property is to live and commercial property is to earn money.

Is commercial better than residential?

It depends on the market. If you are in a business then commercial is better than residential. Because you get repeat customers in the business.

If you are looking at investment, then commercial real estate is the better choice. It is the standard belief that a residential property only appreciates and doesn’t depreciate whereas commercial real estate can depreciate if the building is not properly maintaine.

For example, a typical commercial space can depreciate 5% to 10% in a year due to normal wear and tear. Its maintenance cost will depend upon its location and the amount of traffic it gets.

It all depends on what you have in mind. Residential properties have seen exponential growth in price in recent years, and are predicte to rise even higher. However, commercial properties are not far behind with their performance.

You too can invest in commercial properties for good returns, and still, be able to live in them or run your business from there. Commercial properties make excellent investment vehicles, and you can also defer taxes on rental income from commercial properties.

The commercial is better than residential if you can get it. Commercial real estate is harder to get and more expensive, but it’s a lot safer than buying a house or condominium.

Commercial property can help you build your wealth, understanding the ups and downs of the commercial real estate market. Here are four important things to keep in mind when considering commercial investments.

Is the commercial property worth more than residential?

Yes! Commercial property is a safer investment than residential property.

- There is a huge demand for commercial properties in many cities of India. Big Corporates want to expand their business and hence they want to buy commercial property.

- For residential property, we need a minimum of 3 to 4 years to get it fully occupied whereas for a commercial property we only need 1 or 2 years to get it fully occupied.

- Commercial property is always fully occupied and generating income.

- The rental yield is more for commercial property than residential property.

- Today’s market is the best time to invest in commercial property. To get the best deal in commercial property, you should consult the property broker.

It depends on the location. However, commercial property is always a better investment than residential property. Business property has multiple income streams and fewer expenses. You can easily get a positive cash flow from your business property.

On the other hand, most residential properties are money pits. You need to spend a lot of money to keep them rented and pay all the utilities and taxes.

Investing in commercial property is a more secure investment, as it is hard to fall out of love with an office building. It is also a good investment, as commercial real estate often appreciates faster than residential property.

Conclusion:

If you are looking to invest in property, commercial property is the best way to go. Commercial property is essentially a building that is use for generating income. Residential property is a home that is use for living.